During any financial review, variances against plan are always items of intense discussion and require in-depth analysis. Any accounting or finance professional will tell you that the window of time to unearth the cause of variances is critical. And, of course, this analysis usually occurs during the month-end close process, when things are most hectic.

Variance analysis usually involves comparison of many time periods or benchmarks. However, in this article, we’ll cover COGS variances (i.e., variances to costs of goods sold) versus the annual budget.

Although it would be nice if actual results during the year matched what we initially planned, we all know that business changes are typical after budgets are established, leading to variances and necessary explanations.

Three Components of COGS Variances

Cost of Goods Sold (COGS) refers to the direct costs of all components used during the manufacturing process. Researching COGS variances without a complete understanding of where to look (or without the right tools) can lead you down long and time-consuming paths.

Three main components make up a COGS variance: volume, mix and rates.

- Selling more volume of any or all products than planned will generate a volume variance and affect overall cost. You will see when we talk more about volume variance analysis that as simple as this calculation may seem, you’ll need to take a few steps to separate out the mix component to truly see volume variance.

- Mix occurs when a variety of products are sold at a different volume than planned. Mix variance analysis looks at how the product is weighted, or distributed, amongst its total population. For example, let’s say we sold 100 cans of corn in the total sales volume of 1,000, or 10%, while the plan called for a sale of 8% of canned corn. This mix change of 2% at the canned corn level creates an unfavorable cost variance, or as we say, mix variance.

- Rate fluctuations happen for a variety of reasons and are typically unexpected. These changes can occur, for example, with increases or decreases in vendor pricing on material purchases or in transportation and warehousing costs. Based on the bill of material (BOM), these rates can affect some or all products and have a direct impact on overall costs, which would create a rate variance.

It’s very likely that the impact of a COGS variance is driven by all three components. Over the next few sections, I will outline how to calculate volume, mix and rate. This should help you determine how costs changes are affected by multiple cost drivers.

COGS Variance Component 1: Volume Variance Analysis

Breaking down the impacts that volume, mix and price have on COGS variance adds more complexity and enhances analysis. It also allows you to decompose the volume and pricing performances by product type between budgets and actual values.

Before we explore volume variance, let me first explain the meaning of volume. In the manufacturing industry, volume is most often used to either describe the level of production units produced or sales units sold. Production units produced drives total cost of production (COP), which flows to the balance sheet until sold. In our discussions here, we will be referring to the sales units produced, which drives COGS and appears on the profit and loss statement. Therefore, an increase in sales volume equates to higher COGS, which will have a direct impact on gross margins and company profits. (As a note, keep in mind that there is a latency between a unit that is produced and sold, which can be anywhere from 2-4 months due to logistics constraints, shipping time, customs, etc.)

Naturally, more or less units sold will drive COGS up or down accordingly and reflect on the profit and loss statement, which will result in a variance. To determine the key drivers behind the variances, we must first break down the volume sold by product type and analyze both budget and actual. This will help us see the variances for each product type.

Once we have analyzed it in this way, we then calculate the volume variance using this formula:

Volume Variance = (Plan Quantity – (Total Actual Quantity * Plan Mix)) * Plan Rate

Volume Variance Analysis Example

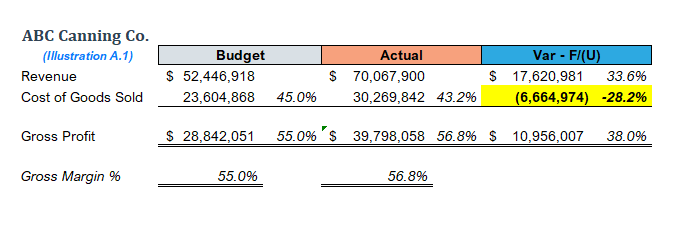

In the example below (Illustration A.1) from ABC Canning Co., we see a condensed P&L with COGS in an unfavorable variance from budget totaling -$6.7M or -28.2%. This alarming, unfavorable variance will inevitably lead to questions.

As mentioned previously, explaining COGS variances is best approached by analyzing the impact by volume, mix and rate, which will help explain the driving factors. When seeing a COGS variance, the questions to ask are:

- How much of the additional cost is related to volume?

- How are the different weighting of product types having an impact on mix?

- And what is the cost impact on the fluctuations on rates and cost changes?

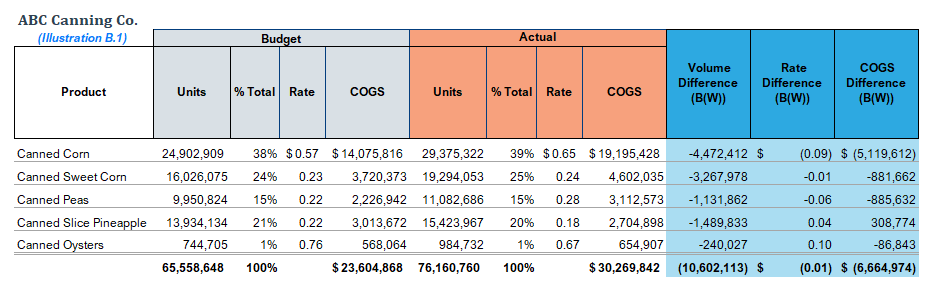

The chart below (Illustration B.1), further analyzes COGS variance by product type, showing volume, cost and price rate for both budget and actual, revealing the total variance of -$6.7M.

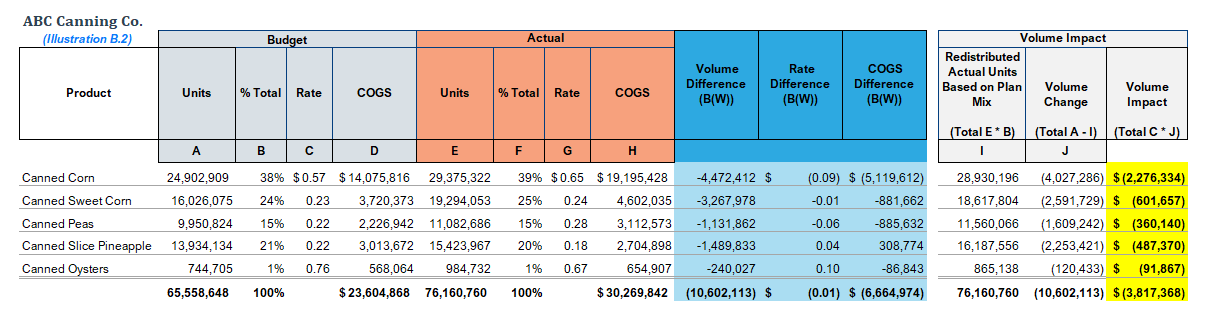

To determine how much of the -$6.7M is related to volume, we apply the calculation described above to each product type as shown in the chart below (Illustration B.2). As the chart below shows, of the total -$6.7M COGS variance, the total volume impact is -$3.8M.

The logic behind the volume variance calculation is to separate:

- Actual mix by applying the actual volume with budget mix, and

- Actual rate by applying the actual volume with budget rate.

To analyze further, if there is no volume change, then there is no mix impact, because the sales volume and mix were at planned levels. However, if total volume is the same, but the individual product volume differs from plan (i.e., creating a mix), then there would be no volume impact, but the individual products would have a mix impact.

COGS Variance Component 2: Mix Variance Analysis

The purpose of mix variance analysis is to see how much of your total COGS variance is due to producing products at a volume different from what was initially planned. The objective is not to compare total volume sold, but instead compare the distribution percentage, or weighting, across all the products that were sold in the time span.

It’s important to note that mix variance will not exist when there is only one product type. With only one product type, variance would come from volume, not mix or rate. Mix variance is created whenever two or more products are included in a product group.

In this analysis, we’ll use budgeted price rate to better isolate actual rate differences and see the true mix impact. This approach reflects the fact that not all products are created (i.e., sold ) equal. A higher or lower sales volume from plan will change the mix in comparison from plan and have a direct impact on COGS. To summarize this concept:

- Selling a higher volume than planned of higher-cost products will generate a high mix and have a negative impact on COGS.

- Selling a lower volume than planned of lower-cost products will generate a low mix and have a positive impact on COGS.

When performing this analysis, use this mix variance calculation:

Mix Variance = (Actual Quantity * (Actual Mix – Plan Mix)) * Plan Rate

Mix Variance Analysis Example

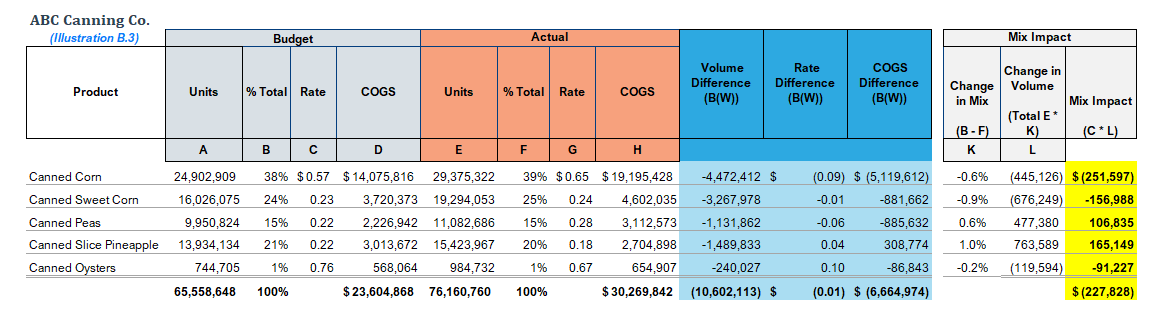

Using a similar data set below (Illustration B.3) for ABC Canning Co. and using the calculations noted above, we can see mix has an impact on COGS totaling -$228K. Canned corn is causing most of this mix variance at -$252K.

Looking further into this product, we see that the planned mix was 38% and actual sales mix was 39%, resulting in a 0.6% increase. Applying this mix increase in our mix calculation shows the change in volume impact was -445K units, which we then multiply against the budget rate of $0.57, resulting in our final mix impact of -$252K.

The logic behind mix variance analysis is to keep total actual volume as-is and focus on the additional costs as it relates to the products’ actual sales distribution in comparison to plan.

COGS Variance Component 3: Rate Variance Analysis

The third and final variance analysis, Rate Variance, is the change in rate and its impact on cost. If the cost of a product is higher or lower in a given period than what was planned, then this higher or lower rate is a Rate Variance.

The calculation for deriving a Rate Variance is as follows:

Rate Variance = (Planned Rate – Actual Rate) X (Actual Quantity)

As noted previously, rate fluctuations can occur for several reasons, including:

- Vendor price increases on material purchases,

- Transportation fee increases on driver wages,

- Higher demurrage charges and

- Warehousing cost increases.

These rate changes have a direct impact on overall costs and will create a Rate Variance.

Rate Variance Analysis Example

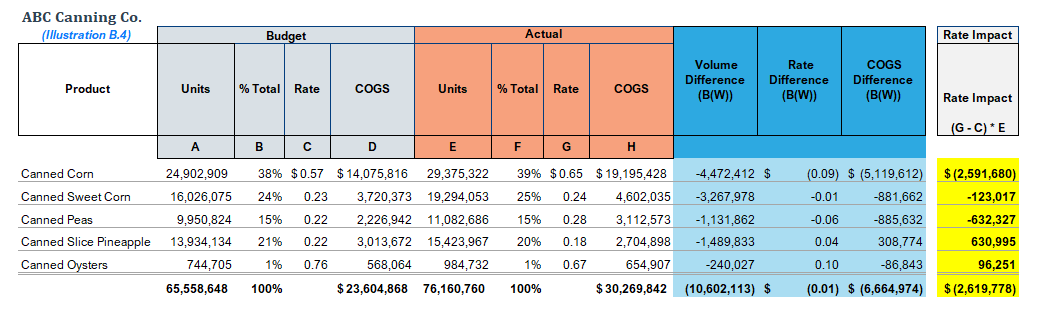

By returning to our example from ABC Canning Co. below (Illustration B.4) and laying out costs for both budget and actual, we see the different rates by product type. Canned corn, for example, was budgeted to cost $0.57/can, while the actual cost was $0.65/can, or a $0.09/can increase. Although it may sound immaterial, when applying these rates against the millions of units sold, we create a large variance that would cause concern for both management and shareholders.

Overall, the actual cost of goods sold totals $30.3M and is over plan by $6.7M. How much is related to rate changes? Applying our calculation above results in a total rate impact of $2.6M, which is simply the difference in rate x actual units sold.

From the list of products below, it appears that canned corn has the highest impact. As mentioned before, the rate increase of $0.09/can result in a cost increase of $2.6M (or 39%) of our total $6.7M variance. It appears that this is where most of the focus needs to be moving forward. But what exactly is causing the cost on canned corn to spike?

The logic behind rate variance analysis is simple and requires no special calculations, as we saw above.

We simply:

- Find the rate difference between plan and actual, and

- Multiply the difference against the actual volume.

Note: If the actual rate had no change, then there wouldn’t be a rate variance.

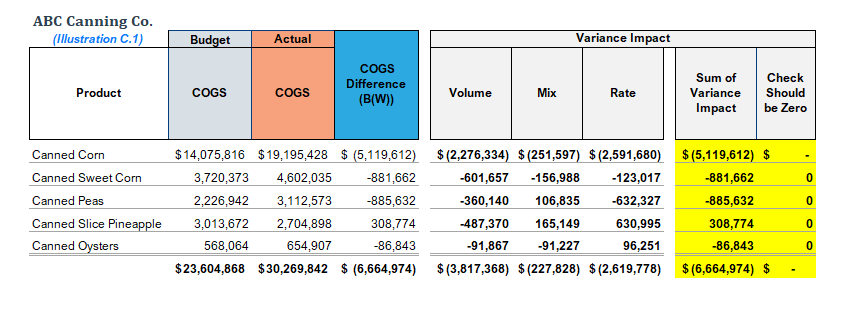

As mentioned previously, all three variances (i.e., volume, mix and rate) can also exist. Nevertheless, no matter how many variances exist, the summation of all the variances must equal the total COGS variance. The chart below (Illustration C.1) illustrates this by showing how the variances for volume, mix and rate total to the COGS variance of $6.7M.

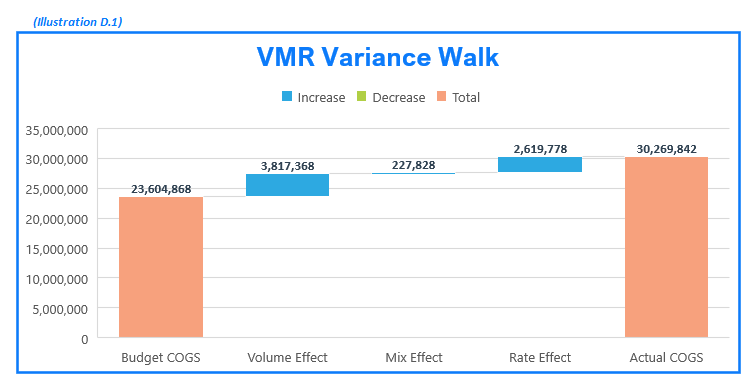

The graph below (Illustration D.1) also represents the variance impacts of volume, mix and rate by demonstrating a “variance walk” from plan to actual. This is another useful visual tool to present to management to help guide and explain the breakdown of the COGS variance. To go further, additional commentary can be explained on each. For example, we might comment on rate analysis based on our above finding that the price on canned corn increased $0.09/can, resulting in a total cost variance of $2.6M or 39% of the overall COGS variance.

Conclusion

Understanding the impact that volume, mix and rate can have on COGS variance—and leveraging modeling tools like the ones described above—will help any finance professional during the month-end close, which is a crucial time for any business. These analysis steps are important for any manufacturing company that desires to fully understand the extent of the COGS variance.

It is easy to simply point at volume as a cause for the additional cost, but as we see in the analysis above, volume is not always the cause. Like an onion, we need to peel away the layers and separate out the causes so that management can better understand fluctuations, ask better questions and make more informed decisions.

Interested in learning more? Explore manufacturing finance and accounting topics in these related posts from our team of consultants:

Additionally, if you’re in need of manufacturing finance consulting support, you can learn more about our services and our consulting team by clicking the image below: