The COVID-19 pandemic will force studio finance professionals to make changes to their film ultimates for this year’s film slate, and it will have a lingering impact on revenues for the foreseeable future. Theaters will reopen to lower attendance that will likely remain low for an extended period. Since theatrical revenue is generally the largest revenue stream on a film ultimate, adjustments to projections need to account for this. Below are some considerations to think about when adjusting film ultimates for the market impact of the novel coronavirus.

Greenlight Ultimates for Smaller-Budget Films

Smaller-budget films will likely be the biggest casualty of the COVID-19 pandemic. A vaccine for the virus is not likely to arrive within the next 12 months, and as a result, we can anticipate smaller theater audiences in the foreseeable future. To increase the probability of larger audiences and more revenue, studios will likely allocate their resources to projects with broader appeal. That means smaller-budget films will have little room to show profit and get greenlit. These films have a smaller revenue stream, and studios will not want to risk the advertising spend for minimal revenue. These greenlight ultimates will require more detailed scenarios focused on what the film profit will look like as straight-to-digital releases in order to justify moving forward on the project.

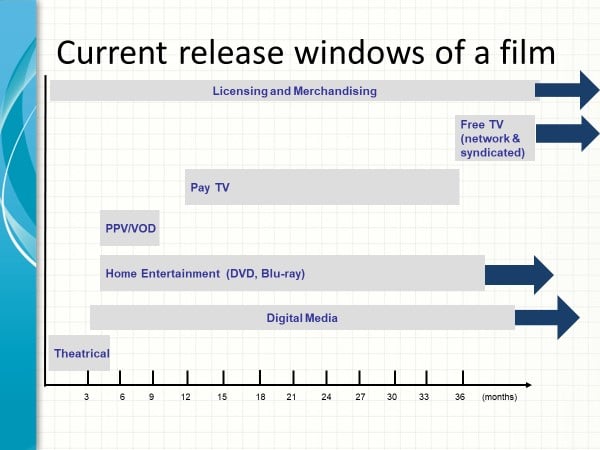

Appropriate Theatrical Window

The COVID-19 pandemic has caused studios to reevaluate the appropriate theatrical release window before films are available digitally. Historically, this window has been three months, but this has been upended by closed theaters. It is unlikely that distributors will be able to force a three-month window once the theaters reopen. Studios will have more control choosing when a film releases digitally, and it will be critical to do the appropriate financial due diligence to determine the best digital release date.

Digital rentals cannibalizing theatrical business is a risk, if releases cross-over between the two channels, so studios must analyze the potential impacts. Tentpole releases may require an earlier digital release to supplement other revenue lines such as licensing while not negatively impacting box office revenue. For other films, having an earlier digital release date may eat into box office sales. Accurate projections of this risk must made.

Digital Footprint by Territory

Film ultimates during this period will see an increase to overall digital sales. Estimates must account for the prevalence of streaming and digital download use in each international territory. Many countries are behind in streaming platform use and do not have the capacity for large digital revenue increases. Since film ultimates are a consolidation of all revenue sources across all territories for the film, estimates should include a deep dive analysis into the digital capacity of each territory to ensure digital revenues are not over inflated.

Advertising Cutbacks and Targeting

Advertising is the primary lever that finance teams can pull to make tangible changes when creating a film ultimate once a film is released. Getting a firm grasp on the most efficient allocation of advertising costs will be more instrumental than usual in determining film profit levels.

For most films, it will be very challenging to completely offset the revenue lost at the box office with digital, home entertainment, and other revenue streams. To maintain the most profit, an advertising cost analysis will be imperative. Films with earlier digital releases dates can piggyback the digital campaign off the theatrical advertising if they are out simultaneously to save costs. Advertising for digital releases should be focused on territories where streaming has a larger footprint in the marketplace.

Additionally, to effectively utilize all advertising dollars across the slate, a significant percentage of advertising will need to be allocated towards the large tentpole films that drive the most revenue. This will leave considerably less advertising dollars for smaller budget films (as mentioned earlier).

TV Revenue Impact

The Premium and Cable TV licensing revenue stream will also feel the impact from the decrease on box office revenue moving forward. Many broadcasting deals between studios and media ownership of TV stations like HBO, Showtime, TNT, etc. include escalators in fees paid that are dependent on each film’s box office performance.

All films will be affected, but the greatest impact will come from larger tentpole films. These films were expected to have top box office numbers and carry the lion share of slate profit, but the expected lower box office results will result in reduced TV revenue as well. This will have a significant impact on the profit for the full film slate, and could result in film investment cuts on the film slate overall. The potential impact will need to be built into the film ultimate revenue estimates. It will likely include a revisit to how TV distribution agreements are structured, and take into account the larger focus on digital rentals that will supplement theatrical revenue moving forward.

Participations Considerations

Participations calculations will be challenging as studios try to determine profitability with the likely shift in theatrical revenues to digital revenues. New digital revenue channels in streaming have made these deals more complicated over the last several years. A sudden spike in the dependence on these revenue streams, could result in a significant miscalculation on the affect to film ultimates. This emphasizes the importance of having a detailed oriented finance team to estimate out these costs.

Want to learn more?

If you’d like to learn more about best practices for staying competitive as a studio, we cover key best practices our operational finance in entertainment ebook.

We also offer additional information about our entertainment finance services in our free, downloadable service sheet: