So, your company has been plodding along with fairly predictable growth in revenue and a stable customer base. Capital expenditures, DSO and DPO have been consistent, as well as inventory turns. Cash flow has been stable, and 13-week cash projections have relied on historical information.

However, the board of directors and executive leadership have announced a major expansion plan for the business, which involves new territories, lines of business, customers, vendors, profitability profiles and changes in inventory policies. To meet these new requirements, the finance department needs to expand its processes to include balance sheet and cash flow projections.

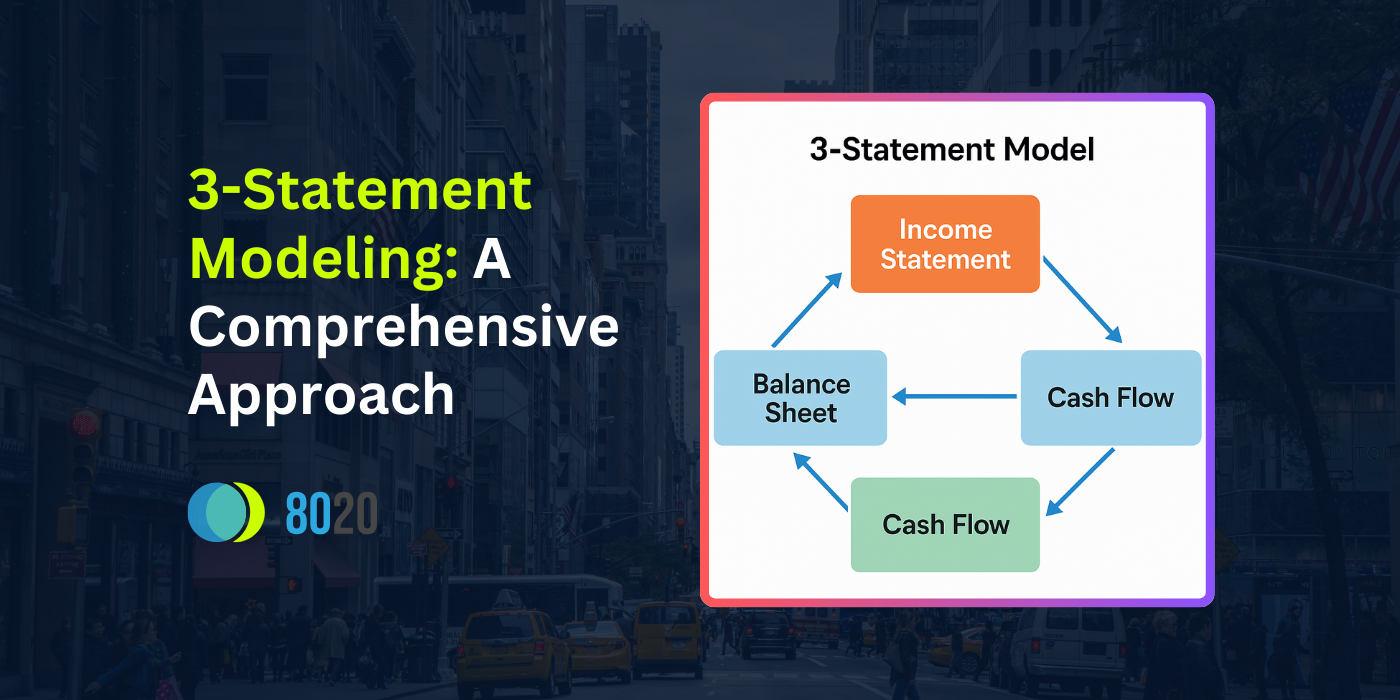

In this blog, we will explore the importance of expanding financial projections to include balance sheet and cash flow forecasting, evaluating new lines of business, creating an integrated financial model, automating relationships between financial statements, and discussing the benefits of 3-statement modeling in providing a comprehensive view of company performance.

|

|

|

|

|

|

Key Takeaways

|

|

Table of Contents

• The 3-Statement Model: Integrating Income Statement, Balance Sheet and Cash Flow

• Benefits of 3-Statement Modeling

• 3-Statement Financial Model Example

The 3-Statement Model: Integrating Income Statement, Balance Sheet and Cash Flow

A 3-statement model is a comprehensive financial model that integrates the income statement, balance sheet and statement of cash flows. It provides a holistic view of a company’s financial performance and future projections. By automating the relationships between these statements, changes in one statement automatically impact the others, providing a more accurate and dynamic representation of the company’s financial position.

Assessing Financial Needs

The output of the cash flow model, specifically the ending cash balance, provides insights into the need for additional funding. If the projected ending cash balance for any period falls below a predetermined threshold, adjusting the level of debt on the balance sheet can increase the ending cash balance in the statement of cash flows and the balance sheet. Changes to debt also impact interest expense, net income and the ending cash balance on the statement of cash flows.

Consolidation and Benefits

Once the 3-statement modeling is completed for all business entities, the finance department consolidates the results into an overall financial model. This model provides the information requested by the executive leadership team and yields several benefits.

Benefits of 3-Statement Modeling

The benefits associated with 3-statement modeling outweigh the costs of development and periodic updates for most companies. In a rapidly changing economic and competitive environment, executive leadership requires a holistic financial model to assess investment needs, funding requirements and solvency. The comprehensive model allows for periodic updates and ad hoc modifications, providing the complete picture needed by leadership.

Expanding Financial Projections

“Garbage in, garbage out” underscores the significance of accurate and clean financial records as the bedrock of reliable forecasts. Ensuring all revenue, cost, capital expenditure and related transactions are promptly recorded in accordance with GAAP standards is crucial.

Special attention is needed, particularly for revenue transactions, which are often the most substantial figures on the income statement. Situations involving non-intuitive revenue recognition rules—common in software, SaaS, contract-based, real estate and certain manufacturing industries—call for scrutiny to ensure accurate recording. Robust internal controls and monthly reconciliations are essential for maintaining precise financial reporting and accounting for all system transactions.

Evaluating New Lines of Business

The expansion into new lines of business will introduce different profitability profiles, new vendors, customers and payment terms. This deviates from the existing business practices, and inventory levels and values are also likely to diverge. Before providing consolidated projections to the leadership, a thorough evaluation of each new line of business is essential.

Integrated Financial Modeling

To fulfill the executive leadership’s requirement for a 5-year outlook, the finance department needs to develop an integrated model for each entity, considering the unique assumptions of the new lines of business. This integration involves establishing relationships between the income statement and balance sheet. For example, projected revenue will impact accounts receivable based on projected DSO assumptions. Automating these relationships ensures that as the income statement is updated, the balance sheet automatically adjusts accordingly.

Similarly, the statement of cash flows is influenced by items on both the income statement and balance sheet. Net income, depreciation and amortization from the income statement affect the cash flow statement, while changes in balance sheet accounts reflect in the statement of cash flows. The financial model for the statement of cash flows should automate these relationships as much as possible, allowing changes in the income statement to ripple through the balance sheet and statement of cash flows with minimal manual intervention.

3-Statement Financial Model Example

In the example of a 3-statement financial model, the data is based on a hypothetical mid-market company preparing for geographic expansion and product diversification. The model brings together projected revenues from the income statement with expected changes in accounts receivable, inventory, and payables on the balance sheet. These elements all influence the timing and volume of cash flows. Key operational assumptions—such as Days Sales Outstanding (DSO), Days Payables Outstanding (DPO), and Days Inventory Outstanding (DIO)—are customized to reflect each new line of business. This setup allows the model to simulate how shifts in operations impact financial outcomes.

The model builds in automated relationships between the financial statements. For example, projected revenue impacts accounts receivable through DSO assumptions. Capital expenditures flow from the income statement to fixed assets on the balance sheet, and depreciation is reflected in both the income and cash flow statements. Net income feeds into retained earnings, and non-cash items like depreciation are adjusted in the cash flow section to determine net cash from operating activities. When ending cash balances fall below a defined threshold, the model triggers debt adjustments on the balance sheet, which then influence interest expenses in the income statement.

This example highlights how a 3-statement model allows finance teams to explore different business scenarios. Whether the company is planning for growth, facing margin pressure, or evaluating new capital investments, the model shows how those decisions affect financial performance across all three statements. It also demonstrates the importance of accurate, GAAP-compliant data and how automation can reduce manual work and errors.

Get Better Financial Models with the Help of 8020 Consulting

Expanding financial projections to include balance sheet and cash flow forecasting is crucial for businesses undergoing significant expansion. By creating an integrated model and automating relationships between the income statement, balance sheet and cash flow, companies gain better insights into funding requirements, cash management and forecasting. The benefits of 3-statement modeling far outweigh the associated costs, enabling executive leadership to make informed decisions in dynamic business environments.

Thanks for reading! To keep up with our consulting team on finance and accounting topics, visit our expert blog. If you’d like to learn more about how we work with clients to improve their FP&A, you can book a free consultation here!