Regardless of the size of your company, you undoubtedly made a significant investment when you purchased Oracle’s Hyperion Financial Management (HFM). It probably took your finance team several months to design, configure, test and convert historical data.

Yet even though the HFM website notes that the financial consolidation, reporting and analysis tool is designed to be maintained by the purchaser, many licensees only utilize a small percentage of HFM’s capabilities. Implementation fatigue can set in, and your finance team will always have competing responsibilities. To help you get the maximum value out of your investment of time and money or decide if the system is right for your company, here’s a quick review of the key benefits of Hyperion Financial Management.

In my experience as a financial systems consultant for over 15 years across dozens of mid-market and enterprise companies, I’ve seen firsthand how underutilized Hyperion Financial Management can become after initial implementation. Many teams invest significant time and resources but fail to unlock its full potential due to competing priorities or limited internal expertise. I’ve helped clients streamline their close processes, improve reporting accuracy, and reduce reliance on IT by optimizing their HFM environments. With the right guidance, companies can turn HFM into a strategic advantage instead of just a compliance tool.

To help you get the maximum value out of your investment of time and money or decide if the system is right for your company, here’s an expert review of the key benefits of Hyperion Financial Management.

|

|

|

|

|

|

Key Takeaways

|

|

Table of Contents

- Do I Really Need a Review of Hyperion Financial Management?

- Key Benefits of Hyperion Financial Management & Consulting

- More Progress, Less Waiting for IT

Do I Really Need a Review of Hyperion Financial Management?

If you’re considering an HFM purchase or have just made the move, you’ll want to learn more about what the system can offer. But many other situations also warrant taking a closer look. If you answer “yes” to any of the following questions, read on to ensure that you are efficiently leveraging this powerful tool.

- Has HFM been in place for so long that it’s now taken for granted?

- Are you a new CFO walking into a company that uses HFM?

- Are newly hired team members unfamiliar with HFM?

- Has your HFM expert moved on?

- Have you recently acquired or merged with a company that uses HFM?

- Are you changing (or do you want to change) how financial information is organized and reported?

- Have new or recent accounting pronouncements required your organization to change how you do your reporting?

No matter which situation may apply, a review of HFM’s key benefits will help you to tap the system’s full potential, keep up with the changing needs of your business and plan more accurately and confidently for the future.

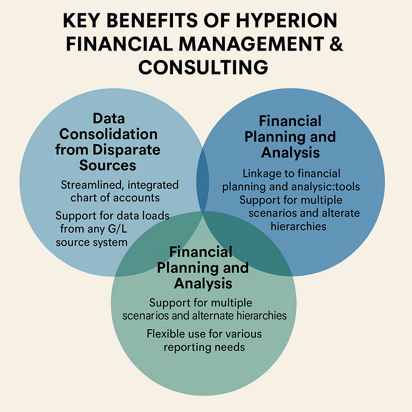

Key Benefits of Hyperion Financial Management & Consulting

Many of HFM’s key benefits can be grouped into three basic categories:

#1 Consolidation of Data from Disparate Sources

In my work with clients, one recurring challenge is managing financial data across multiple systems and currencies. I remember a project with a fast-growing tech company that had recently expanded through acquisition and was struggling to align reporting across new entities. Hyperion Financial Management helped us centralize their data and establish consistency without requiring immediate ERP migrations, which saved both time and budget.

HFM provides:

- A single streamlined and integrated chart of accounts that can be utilized for all entities

- A standard chart of accounts in HFM can (and often does) differ from the chart of accounts in source systems.

- Support for data loads from any general ledger (G/L) source system

- As new entities are acquired or merged into the business, data can be integrated while new companies remain on their existing ERP platforms.

- Data is loaded in local currency, allowing subsidiaries to report and budget in local currency while the parent company can report in US dollars or another currency.

- A single “version of the truth”

- Loading actuals, forecasts, budgets and other data in one place eliminates version control issues and reduces errors.

#2 – Financial Planning and Analysis

- Hyperion Financial Management can be linked to financial planning and analysis tools as either a source or destination.

- Actuals can be exported in a flat file to be loaded into planning tools as a baseline for annual operating plans.

- Budgets or forecasts from other planning tools can be loaded into HFM via flat file or Excel.

- Scenario management allows multiple budgets or forecasts to be stored and used for variance analysis.

- Alternate hierarchies allow flexible use of the system for statutory reporting, management reporting, geographical reporting or tax reporting.

#3 – Additional Operational Features

- HFM can be used to store non-financial data including headcount, office square footage, accounts payable, accounts receivable and inventory aging.

- Allows management to calculate and track KPIs

- Custom dimensionality enables the consolidation of like cost centers, profit centers or departments across entities.

- Up to four custom dimensions can be defined by your company to best serve your needs and increase reporting flexibility.

- Intercompany matching helps identify discrepancies and aids in reducing close time.

- The flexibility and power of VBscript allow you to design the system for customized calculations.

- HFM can be linked with Hyperion Financial Reporting to create standardized reports which can be produced in PDF, HTML or as an Excel export format.

- Allows for more efficient reporting and distribution to non-HFM users

More Progress, Less Waiting for IT

HFM can be supported and maintained by your finance team rather than your IT team, meaning that information can be entered and utilized more efficiently. No one wants their work to be held up waiting for IT to enter a new account, for example, and HFM offers a do-it-yourself advantage.

When an Experienced Consultant Can Help

Going live on any new financial system implementation can be stressful and disruptive to a finance team already being pulled in many different directions. As a result, things can easily get left undone. If this sounds familiar or you’re struggling for other reasons to get the most out of Hyperion Financial Management, a consultant who is fluent in the system can set you on the right course and save you time, money and a lot of frustration. Assistance can range from education about benefits or implementation best practices to the identification and elimination of redundancies so that your four customized dimensions are being put to optimal use. If you’re already working with a consultant or an Interim CFO, ask him or her to offer suggestions!

Are you getting the most out of your investment in Hyperion Financial Management? We’d be happy to help you better leverage this powerful tool. You can contact us here, or click on the image below to learn more about how we work with clients specific to financial systems.