There’s no easy approach to preparing a company-wide annual budget. I have learned, however, over many years of preparing budgets, that the best budgets involve careful, organized and methodical planning. Staying ahead of the game by doing as much leg work ahead of the budget deadlines will reward you immensely. While the methodology for preparing a budget can come in different forms, I believe the best method is one called zero-based budgeting.

Zero-based budgeting (ZBB) is a process in which all expenses are justified for each new period. This methodology helps align the company’s planned spending with its strategic revenue goals. ZBB requires organizations to build their annual budget from zero each year to verify that all components of the annual budget are justified, cost-effective through current pricing and drive improved savings. So, as the name implies, zero-based budgeting starts from a “zero-base,” and at each period, detailed spendings are layered from the “bottom up.”

How is this method different from traditional budgeting methods? Let’s go over the differences, explore pros and cons and go through the process steps of completing a ZBB – with examples and a template.

|

|

|

|

|

|

Key Takeaways

|

|

Table of Contents

- Zero-Based Budgeting vs. Traditional Budgeting

- Pros of Zero-Based Budgeting vs. Traditional Budgeting

- Cons of Zero-Based Budgeting vs. Traditional Budgeting

- Steps Towards Completing a Zero-Based Budget

- Stakeholder Responsibilities with Zero-Based Budgeting

- Why Should Companies Adopt Zero-Based Budgeting?

Zero-Based Budgeting vs. Traditional Budgeting

As noted above, zero-based budgeting is a method in which all expenses must be justified for each new period. This contrasts with traditional budgeting, where budgets are based on previous periods’ spending with adjustments for known add-ons and growth expectations. ZBB requires department stakeholders to start from a “zero base” and build their budgets from scratch to build-up to an expected guidance preset by executive management. The overall guidance is derived from the company’s strategic operating plan.

Because of the additional work involved to rebuild the budget from scratch, ZBB can be more time-consuming, but it can also lead to more efficiency as all expenses are closely scrutinized and revisited. Traditional budgeting can be quicker, but it can lead to unnecessary expenses as expenses are not closely examined. For example, a monthly software subscription that is not expected to continue may get carried into the next budget period inadvertently using the traditional method. Or contractor rates may not be updated to reflect vendor increases.

ZBB is comprehensive and thorough and does require more time and resources to complete compared to traditional budgeting, but it can lead to more accuracy, which in turn will be beneficial when it comes to budget vs. actual variance gaps.

Pros of Zero-Based Budgeting vs. Traditional Budgeting

I believe the pros outnumber the cons when it comes to using the ZBB method. For example, zero-based budgeting:

- Forces the stakeholders to reevaluate all expenses and determine their necessity, which can lead to cost savings.

- Helps to identify and eliminate unnecessary expenses and redirect resources to more important areas.

- Provides a more accurate picture of an organization’s financial situation, as all expenses are accounted for and justified.

- Helps to align expenses with strategic goals and objectives, ensuring that resources are being used effectively.

- Promotes accountability and transparency in the budgeting process, as all expenses are clearly justified and explained.

Cons of Zero-Based Budgeting vs. Traditional Budgeting

On the other hand, ZBB does have its weaknesses. For companies that have routinely used the traditional style of budgeting, ZBB will at first come with a heavy price: converting the mindset of the finance team and department stakeholders to accept the new methodology. ZBB can also be a complex and time-consuming process, requiring significant data gathering and analysis. Other weaknesses are the dismissal of any seasonal spending behaviors or historical data of the organization that would have been used in a traditional budget process.

Steps Towards Completing a Zero-Based Budget

Implementing a zero-based budgeting (ZBB) approach may seem daunting at first, but breaking the process into clear, manageable steps can make it far more approachable. Unlike traditional budgeting methods, ZBB requires a fresh start each period—so having the right structure, tools and communication strategy is critical to success.

1. Use a Corporate Budgeting Template

The process of completing a zero-based budget typically involves the use of a budget template. The budget template should be considered a financial tool and laid out in a way to allow the stakeholder to simply input spending based on expected need. As a source of reference, it would be helpful if the template contained, off to the right of the 12-month input field, the prior-year spending as well as the prior-year budget. Shared service expenses that are driven by headcount should already be built into the template so that the stakeholder only needs to input the headcount in the headcount field.

The process of completing a zero-based budget typically involves the use of a budget template. The budget template should be considered a financial tool and laid out in way to allow the stakeholder to simply input spending based on expected need. As a source of reference, it would be helpful if the template contained, off to the right of the 12-month input field, the prior-year spending as well as the prior-year budget. Shared service expenses that are driven by headcount should already be built into the template so that the stakeholder only needs to input the headcount in the headcount field.

Providing the template to the stakeholder well in advance of the due date will give time to the stakeholder to collect and analyze data, as well as review past performances, sales figures and other relevant information to assist with developing the budget. Depending on the level of spending required, the stakeholder may need to identify all activities that the department undertakes from both a fixed and variable cost perspective.

Zero-Based Budgeting Template for Corporations

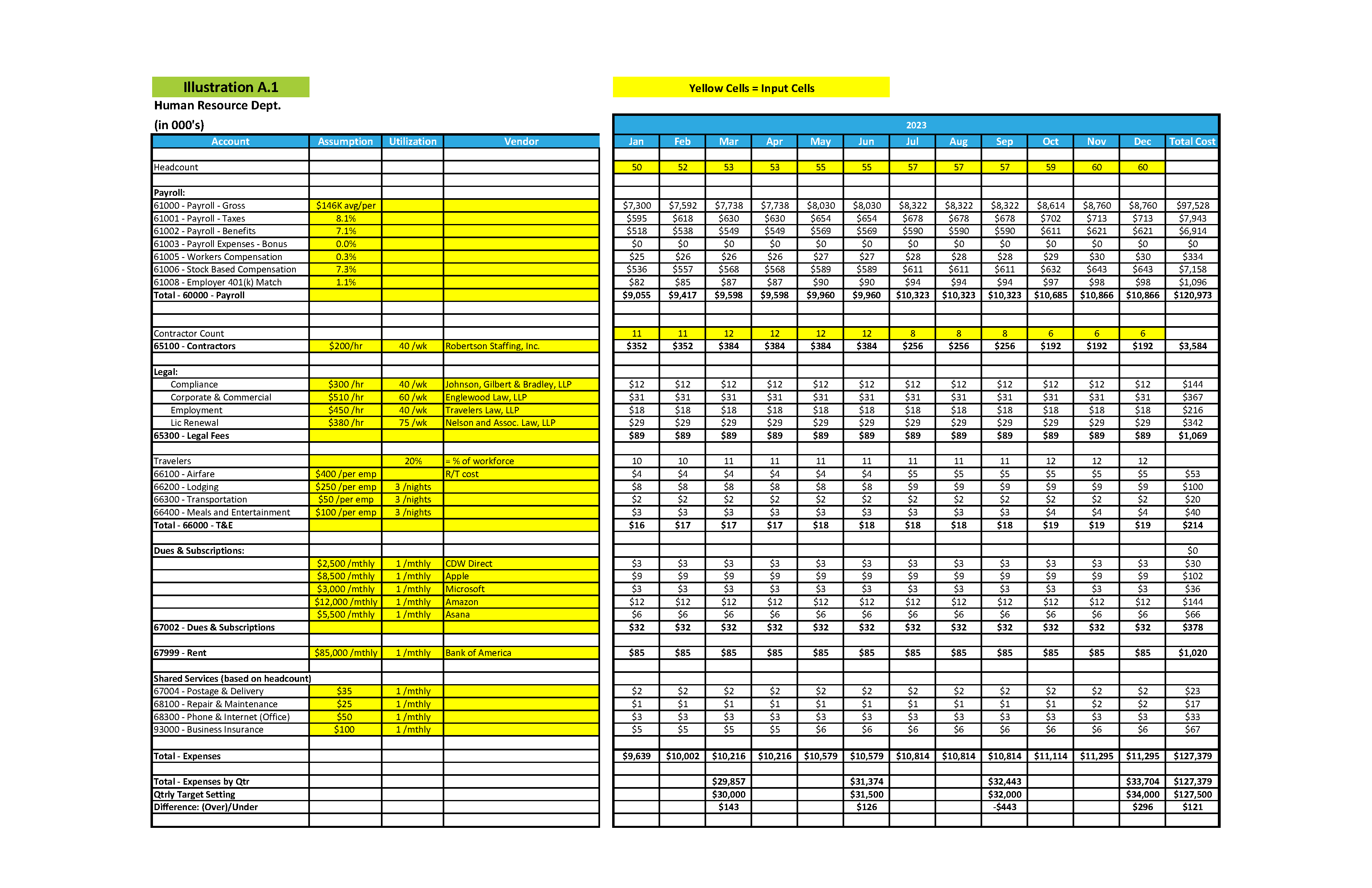

Illustration A.1 below is an example of how a ZBB template can be laid out. Notice the level of detail and tasks associated to each account. Headcount detail should be listed in a separate template for confidentiality reasons, and only the headcount number should be carried over to the opex template.

At the bottom of the template are preset targets set by executive management and coming from the strategic operating model. These targets are the “not to exceed” baseline targets, and the stakeholders can apply expenses up to this amount. Any variance over or under will be shown at the bottom.

Also, it’s clearly noted that the yellow cells are input cells, thus leaving all other cells as calculated cells and not to be manipulated. The more user-friendly, yet data-heavy you set the template to be, the easily it will be for the user to work through it without any issues, which in turn will make your life easier when the template is returned to you for consolidation and due diligence. At this point, all the user needs to do is add the headcount, apply the assumptions and add any additional vendor rows as needed.

In our example below, the total budget target set for the Human Resource department is $127.5M and the total budget that the stakeholder is submitting is $127.38M, lower by $120K. Although this may be acceptable, the amounts submitted by quarter (namely Q3) shows an amount that exceeds the target by -$443K. Clearly, this would necessitate a discussion and decision between the stakeholder, finance and the executive team to decide on how to proceed.

2. Provide the Template to Stakeholders Well Before the Due Date

Providing the template to the stakeholder well in advance of the due date will give time to the stakeholder to collect and analyze data, as well as review past performances, sales figures and other relevant information to assist with developing the budget. Depending on the level of spending required, the stakeholder may need to identify all activities that the department undertakes from both a fixed and variable cost perspective.

Stakeholder Responsibilities with Zero-Based Budgeting

What exactly are the responsibilities of all the players involved in the preparation of a zero-based budget? Here are key players and their responsibilities:

- Management is responsible for setting the overall goals and objectives for the organization and for ensuring that the budget is aligned with those goals. They also play a key role in allocating resources and approving the final budget.

- Finance/FP&A oversees the budgeting process. They are responsible for setting up the templates, issuing the templates to the stakeholders and setting a return by date. They also must communicate with and assist the stakeholders by reviewing the returned templates, consolidating all departmental templates and making recommendations for changes or adjustments.

- Department Heads/Stakeholders are responsible for identifying all the activities their departments undertake and the associated costs. They are also responsible for prioritizing activities and allocating resources to them. They also need to monitor their budget throughout the budget period and adjust as needed.

All those involved in the budget process need to work together to ensure that the budgeting process is thorough and effective and that the final budget is aligned with the organization’s goals and objectives. This requires clear communication and coordination among all stakeholders to ensure that all activities are closely scrutinized and the budget is regularly monitored and updated as needed.

Why Should Companies Adopt Zero-Based Budgeting?

As noted above, there are several benefits of using ZBB. The most important is the level of awareness that it brings to company stakeholders. Rather than simply bringing budgets from the previous year’s budget, ZBB forces managers to justify all expenses and allocate resources based on:

- Current needs,

- Current rates and

- Priorities.

This conscious process can help the company identify and eliminate unnecessary costs, improve operational efficiency and better align spending with strategic goals. Additionally, ZBB can also lead to more accurate forecasting and budgeting, as well as improved decision-making by providing a more detailed understanding of the costs associated with different activities and programs.

Having a solid budget that the company can use to plan their year is very important – it’s essentially the backbone of the company. Which is why the use of zero-based budgeting is so useful. So, if everyone involved in the budget process plays their cards right, ZBB can lead the company to more efficient use of resources and better alignment with organizational goals and objectives.

Stay in the Know

If you’re interested in learning more, we invite you to explore our expert blog. You’ll receive email notifications whenever our team of finance and accounting consultants posts new content.

If you’d like to learn more about how we work with our Clients on FP&A engagements, you can jump to our service page, where we’ve included an overview, example projects and more: